What Is Marginal Utility?

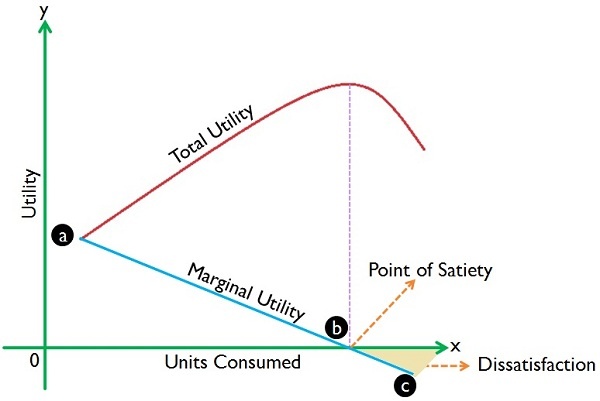

Marginal utility quantifies the added satisfaction that a consumer garners from consuming additional units of goods or services. The concept of marginal utility is used by economists to determine how much of an item consumers are willing to purchase. Positive marginal utility occurs when the consumption of an additional item increases the total utility, while negative marginal utility occurs when the consumption of an additional item decreases the total utility.

How Marginal Utility Works

Economists utilize the concept of marginal utility to gauge how satisfaction levels affect consumer decisions. Economists have also identified a concept known as the law of diminishing marginal utility, which describes how the first unit of consumption of a good or service carries more utility than subsequent units.

Example of Marginal Utility

Marginal utility may be illustrated by the following example.

David has four bottles of water, then decides to purchase a fifth bottle. Meanwhile, Kevin has 50 bottles of water and likewise decides to buy an additional bottle. In this case, David experiences more utility, because his extra bottle increases his total water supply by 25%, while Kevin’s additional bottle augments his supply by a mere 2%.

The chief takeaway from this scenario is that the marginal utility of a buyer who acquires more and more of a product steadily declines until he has zero need for any additional units of the good or service. At that point, the marginal utility of the next unit equals zero.

The concept of marginal utility sprouted from the minds of 19th-century economists who were attempting to explain the economic reality of price, which they believed was driven by a product’s utility. However, this led to a conundrum known as the “the paradox of water and diamonds,” which is attributed to “The Wealth of Nations” author Adam Smith, which states that water has far less value than diamonds, even though water is vital to human life. Since marginal utility and marginal cost are used to determine price, this is paradoxical because the marginal cost of water is much lower than that of diamonds.

Key Takeaway

- Marginal utility quantifies the added satisfaction a consumer garners from consuming additional units of goods or services.

- The concept of marginal utility is used by economists to determine how much of an item consumers are willing to purchase.

- Positive marginal utility occurs when the consumption of an additional item increases the total utility, while negative marginal utility occurs when the consumption of an additional item decreases the total utility.

- The concept of marginal utility sprouted from the minds of 19th-century economists who were attempting to explain the economic reality of price, which they believed was driven by a product’s utility.

There are multiple kinds of marginal utility. Three of the most common ones are as follows:

- Zero marginal utility is when having more of an item brings no extra measure of satisfaction. For example, if you receive two copies of the same issue of a magazine, that extra copy has little added value.

- Positive marginal utility is when buying extra versions of an item is satisfying. One such example would be a store promotion where customers can walk out with a free pair of shoes if they buy two pairs up front.

- Negative marginal utility is where too much of an item is actually detrimental. For example, while the correct dose of antibiotics can kill harmful bacteria, too much can harm a person’s body.